Because of rising storm damage and stricter underwriting standards, insurance companies in Minnesota are increasingly requiring homeowners to replace their roofs to maintain coverage. Older or damaged roofs pose a higher risk for claims, prompting insurers to take a more proactive approach.

It’s a frustrating situation that’s catching more Minnesota homeowners off guard: they go to renew their policy and are told their roof must be replaced immediately. Even without active leaks or visible damage, insurance providers are issuing non-renewal notices or demanding upgrades simply due to roof age or prior storm history.

This shift has left many wondering: why now, and what can I do about it? That’s where we come in. Our team will help you through the process of insurance-driven roof replacements, and we’re here to break down what’s happening, why it matters, and how to take the right next step.

What’s Behind New Insurance Roof Requirements?

Minnesota’s weather patterns are increasingly volatile. Minnesota ranked third nationally for hail events in 2022, and a single storm in 2023 caused over $1 billion in damage. With the average roof claim nearing $30,000, insurers are becoming more risk-averse, especially with older or worn-out roofs.

- Requiring full roof replacements for older systems (typically 15-20 years old)

- Covering only the actual cash value rather than replacement cost for older roofs

- Increasing wind/hail deductibles

This means even if your roof isn’t actively leaking, your insurance company may still demand a replacement to avoid future liability.

What Do Insurance Companies Look for During a Roof Inspection?

Before renewing your homeowner’s insurance policy, your provider might schedule a roof inspection and knowing what they’re looking for can give you a helpful head start. First thing to take note of is your roof’s age, since older roofs are generally more prone to damage.

The type of material used is also important, as some roofing materials naturally last longer than others. Inspectors will check for overall condition, keeping an eye out for signs of wear like curling or missing shingles, and they’ll also evaluate the quality of the original installation — poor workmanship can reduce a roof’s lifespan. Ventilation matters, too; proper airflow helps prevent moisture buildup that can lead to mold or rot.

Lastly, if there have been any past repairs, insurers will look for signs of patchwork or temporary fixes. Understanding these key factors can help you stay ahead of any issues and keep your policy in good standing!

Can I Appeal an Insurance Company’s Roof Replacement Requirement?

If you believe your roof is in good condition despite your insurer’s directive, you have options:

- Request a Second Inspection: Engage an independent roofing contractor for an unbiased assessment.

- Document the Condition: Gather photos and maintenance records to support your case.

- Communicate with Your Insurer: Present your evidence and discuss potential alternatives.

- Schedule a Free Roof Inspection – Our experts will assess your roof’s condition.

- Get Detailed Documentation – We’ll provide photos and notes to support your claim.

- File Your Claim – Submit your claim with our documentation.

- Meet With Your Adjuster – We can meet with your adjuster to advocate for you.

- Roof Replacement – If approved, we’ll complete your roof quickly and professionally.

Pro tip: We offer free inspections and can provide the documentation needed to assist in your appeal.

What Happens If I Don’t Replace My Roof?

If you choose not to replace your roof when recommended by your insurance provider, you could risk losing full or partial coverage, facing higher premiums, or having claims denied if damage occurs. Taking a proactive approach with a roof replacement not only helps you stay protected during storm season but can also save you money and hassle in the long run.

How Do I Know If My Roof Is at Risk?

Common signs your roof may not meet current insurance standards include curling or missing shingles, frequent ice dams, leaks or water stains inside your home, a roof that’s over 15 years old, or visible storm damage from hail or wind. If any of these issues sound familiar, it’s time to schedule an inspection, and we can help with that.

What Does the Insurance Claim Process Look Like?

We know insurance claims can feel overwhelming, but we’re here to make it easier. Here’s what we recommend:

We’ve helped thousands of homeowners through this exact process, we’ll be by your side every step of the way.

What if My Roof Isn’t Covered by Insurance Yet?

Even if your insurance company hasn’t required a replacement yet, it pays to stay ahead of potential issues. A free inspection from our team can identify early signs of wear and help you avoid higher premiums — or worse, losing your coverage altogether.

Why Choose Schmidt Roofing?

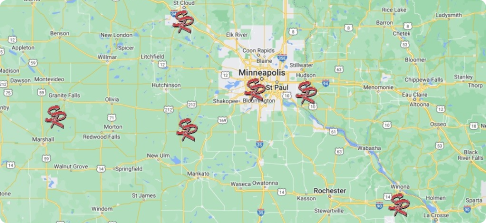

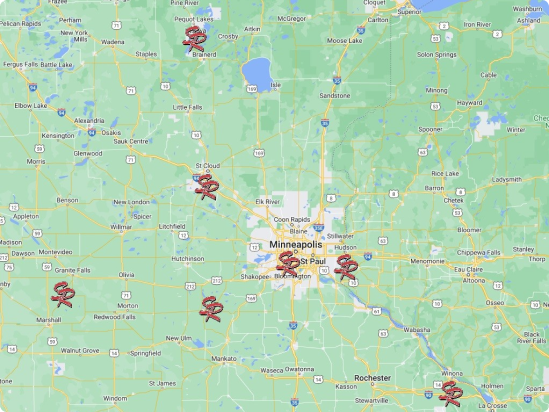

Our team has proudly served Minnesota as trusted local roofing specialists since 1991, completing over 20,000 projects with precision and professionalism. As a BBB-Accredited Business with an A+ rating and certified by top manufacturers like GAF and TAMKO, we’re committed to delivering quality craftsmanship and reliable service every step of the way.

Whether you need a small repair or a full roof replacement, you can count on us for expert guidance, free estimates, and the peace of mind that comes with working with a team dedicated to excellence.

Protect Your Home and Policy With Schmidt Roofing

Your roof is your home’s first line of defense, and we’re here to make sure it stays strong. If you’ve received a notice from your insurance provider, or simply want peace of mind, schedule your free roof inspection or try our Instant Roofing Quote tool today.

Our team combines expertise with transparency so you can make informed decisions about your home. Let’s protect what matters most, together. Contact us today!