Understanding the details of your homeowner’s insurance policy before facing a problem like storm-related roof damage is essential. Many policies cover roof repair or replacement due to storm damage, but the specifics will depend on your insurance provider and the unique aspects of your policy. It’s crucial to take note of your deductible as well, which is the amount you’ll have to pay out of pocket before your insurance coverage begins to kick in. Your policy should outline this deductible clearly, providing an understanding of your potential costs upfront, so make sure to read it thoroughly. Taking the time to understand your policy will help ensure that you’re not caught by surprise if a storm damages your roof and you need to make an insurance claim.

What should you do if a storm damages your roof and you need to make an insurance claim? Follow these tips to make the most of a bad situation.

Engage a Professional Roofing Company

After a storm, it’s crucial to engage a professional roofing company to inspect your roof for potential damage. Trained experts will know exactly what to look for, including subtle signs of damage that may not be immediately visible to the untrained eye. This step is vital because roof damage can lead to other significant problems over time, such as water damage and structural issues if addressed slowly and professionally.

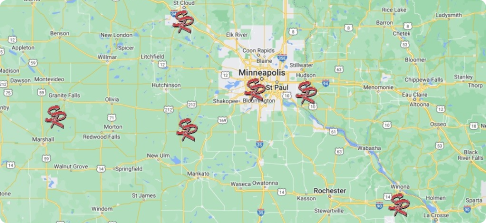

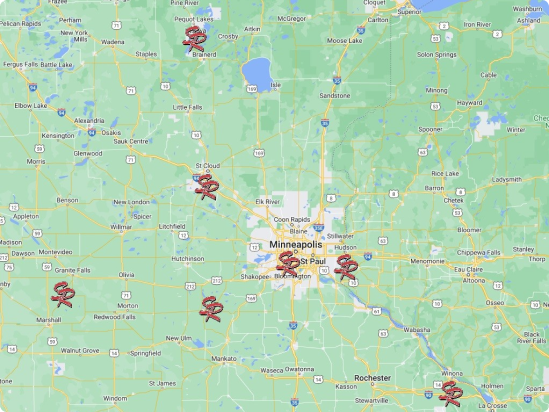

Our roofing professionals at Schmidt Roofing can provide a detailed and accurate assessment of the damage and work with your insurance company to facilitate the claims process. We have experience in insurance negotiations and can ensure that all damage is appropriately accounted for.

Document Your Roof Damage

Documentation of the damage sustained to your roof is crucial in dealing with insurance claims. This involves taking photographs or video footage of the damage and any related damage within your home, such as water stains or leaks. Be sure to capture all angles and dimensions of the damage, as these visuals can be invaluable when filing your insurance claim.

Written documentation should also be included. Write down all details related to the storm and the subsequent damage. Include the date and time of the storm, the type of weather event, and a detailed description of the damage. Keep a record of all communication with your insurance company and the roofing company, including emails, letters, and notes from phone conversations. We can help you document all of this to get you the best result.

Estimation of Roofing Damage by Our Team

Once our crews have assessed the damage, the next step is to get an estimate for the cost of the roof repair or roofing replacement. This estimate is critical to have in hand when we contact your insurance company to ensure all costs are appropriately covered. We will directly with your insurance company so that the process is as easy as possible for you.

Our team will help streamline the claims process by providing the necessary documentation, assisting in negotiations, and ensuring that the insurance company thoroughly understands the extent of the damage and the associated costs.

Working with Your Insurance Company

Once you’ve collected all the necessary information and documentation, it’s time to contact your insurance company to start the claim process. Provide all the details from your documentation, including the damage assessment, photos, and the estimate for repairs or roofing replacement. Be prepared to share all communication records you’ve had with the roofing company.

Following the initial contact, your insurance company will likely send an adjuster to inspect the damage. This is an industry professional who determines the amount the insurance company will pay for the repairs.

Receiving Payout and Starting Repairs

After your insurance company has assessed the claim, they’ll issue a payout to cover the cost of repairs or replacement minus your policy’s deductible. It’s important to review this payout carefully and ensure it covers all the necessary work. We will negotiate with your insurance company if there’s a discrepancy.

With the payout from the insurance company, you can now begin the roof repair or replacement. We will guide you through this process, ensuring that all damage is repaired and your roof is restored to its pre-storm condition. Remember, taking the time to understand each step in this process can help make navigating a roof damage insurance claim far less daunting and far more manageable.